Fixed rate mortgage calculator excel

If a loan is named a 51 ARM then what that means is the loan is fixed for the first 5 years then the rate resets each year thereafter. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates.

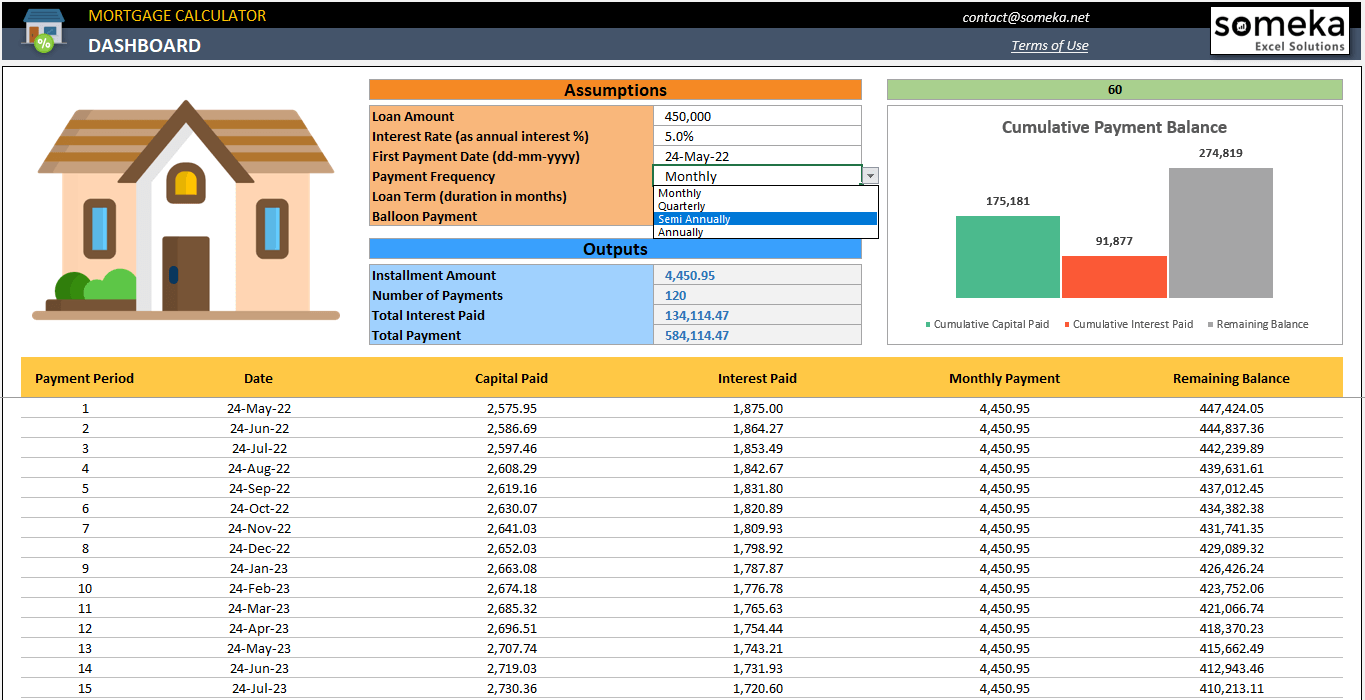

3 Ways To Create A Mortgage Calculator With Microsoft Excel Otosection

When interest rates drop consider refinancing to shorten the term of your mortgage and pay significantly.

. The monthly interest rate is calculated via a formula but the rate can also be input manually if needed ie. Those on a fixed income or those who cannot verify their income in the traditional sense may not qualify for a Conventional loan. Capitalization rate should not be a single factor in estimating whether a property is worth investing in.

That can be detrimental and can lead us to make the wrong capital investment decision. FREE Reverse Mortgage Amortization Calculator Excel File August 6. My goal was to use the Loan Calculator with options in order to use the Extra payments feature but before doing so I wanted to make sure that this calculator would give the same results as the Fixed Principal Payment Calculator which was not the case.

Getting a mortgage with a lower interest rate is one of the best reasons to refinance. Interest rate - the loans stated APR. Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments.

Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. See how those payments break down over your loan term with our amortization calculator. To understand how this works lets take the example below.

Using the following values in the PMT formula in excel. The CUMIPMT function requires the Analysis. Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions.

Loan term in years - most fixed-rate home loans across the United States are scheduled to amortize over 30 years. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float.

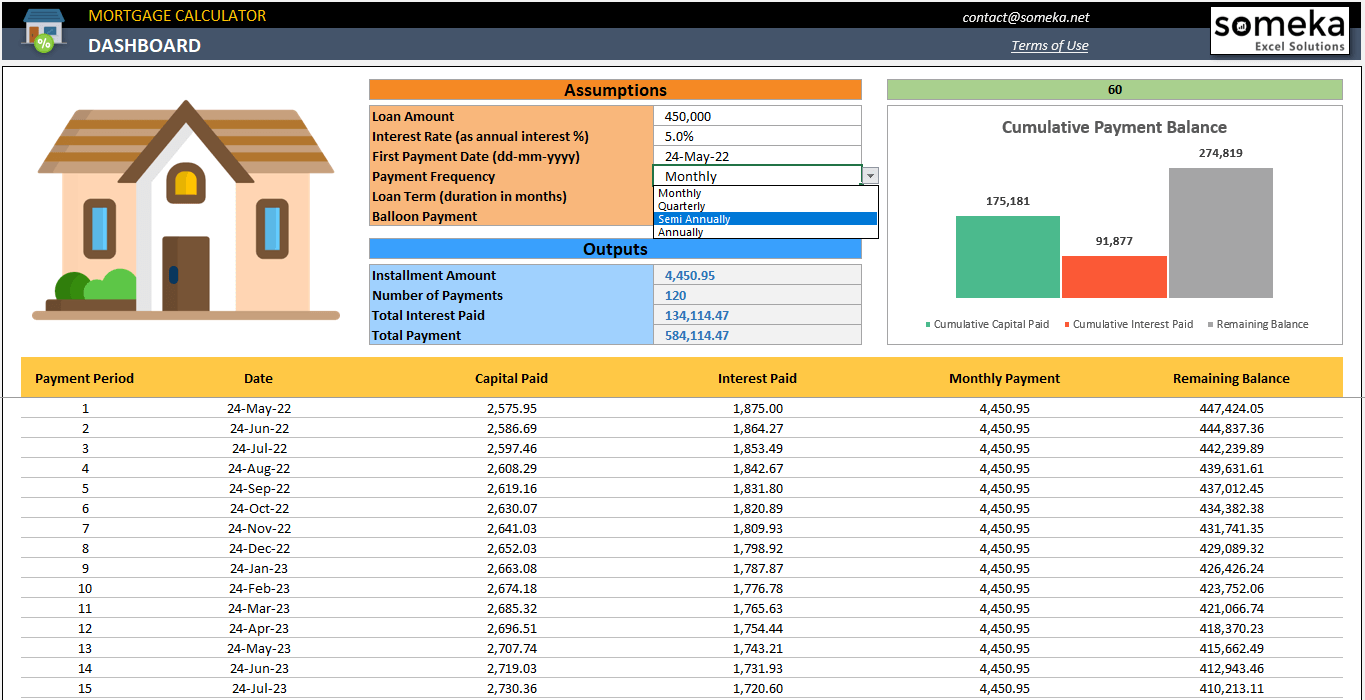

The mortgage amortization schedule shows how much in principal and interest is paid over time. For Excel 2003. Monthly EMI PMT Monthly Interest Rate Tenure in Months Loan Amount This is loan EMI calculator excel sheet formula.

You change any input. After the initial introductory period the loan shifts from acting like a fixed-rate mortgage to behaving like an adjustable-rate mortgage where rates are allowed to float or reset each year. Imagine a 500000 mortgage with a 30-year fixed interest rate of 5.

This provides a ballpark estimate of the required minimum income to afford a home. Loan Tenure in Months 25 years 12 300 months. Loan Amount Rs 50 lakh.

Monthly Interest Rate 812 0. Here we discuss How to Calculate Capitalization Rate along with practical examples. This has been a guide to Capitalization Rate formula.

Current Redmond Mortgage Refinance Rates on a 260000 Fixed-rate Mortgage. If the required rate of return from the project is sat 10 and the average rate of return is coming out to be 15 that project will look worth investing. If you paid an extra 500 per month youd save around 153000 over the full loan term and it would result in a full payoff after about 21 years and three months.

Loan amount - the amount borrowed or the value of the home after your down payment. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. Like we have discussed above the time value of money has been ignored in the average rate of return formula.

Download a free ARM calculator for Excel that estimates the monthly payments and amortization schedule for an adjustable rate mortgageThis spreadsheet is one of the only ARM calculators that allows you to also include additional payments. Before applying for a mortgage you can use our calculator above. We also provide a Capitalization Rate Calculator with downloadable excel template.

Loan amount RMB 1080000 Number of payments 216. We use the excel formula PMT to calculate home loan EMI.

Mortgage Calculator Excel Template Adjustable Rate Mortgage

Excel Formula Estimate Mortgage Payment Exceljet

Excel Magic Trick 407 Amortization Table W Variable Rate Youtube

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

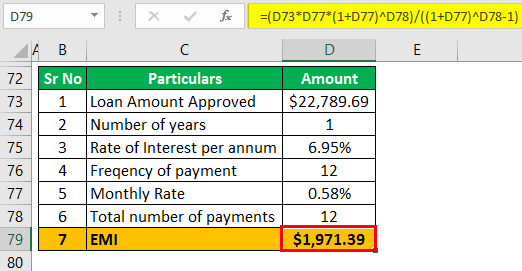

Loan Amortization Schedule With Variable Interest Rate In Excel

Mortgage Formula Examples With Excel Template Otosection

Adjustable Rate Mortgage Calculator Excel Spreadsheet Templates

Variable Rate Mortgage Repayment Calculator Build An Amortisation Table In Excel Youtube

Download A Free Home Mortgage Calculator For Excel Analyze A Fixed Or Variable Rate Mortgage And Inclu Mortgage Loans Financial Calculators Refinance Mortgage

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Adjustable Rate Mortgage Calculator Step By Step

Loan Amortization Schedule With Variable Interest Rate In Excel

Extra Payment Mortgage Calculator For Excel

Free Interest Only Loan Calculator For Excel

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment